New 1099 Rules 2024 Changes – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . Ready or not, the 2024 tax filing to provide Form 1099-Ks to taxpayers who received $20,000 or more through payment apps and made 200 or more transactions. However, new changes outlined .

New 1099 Rules 2024 Changes

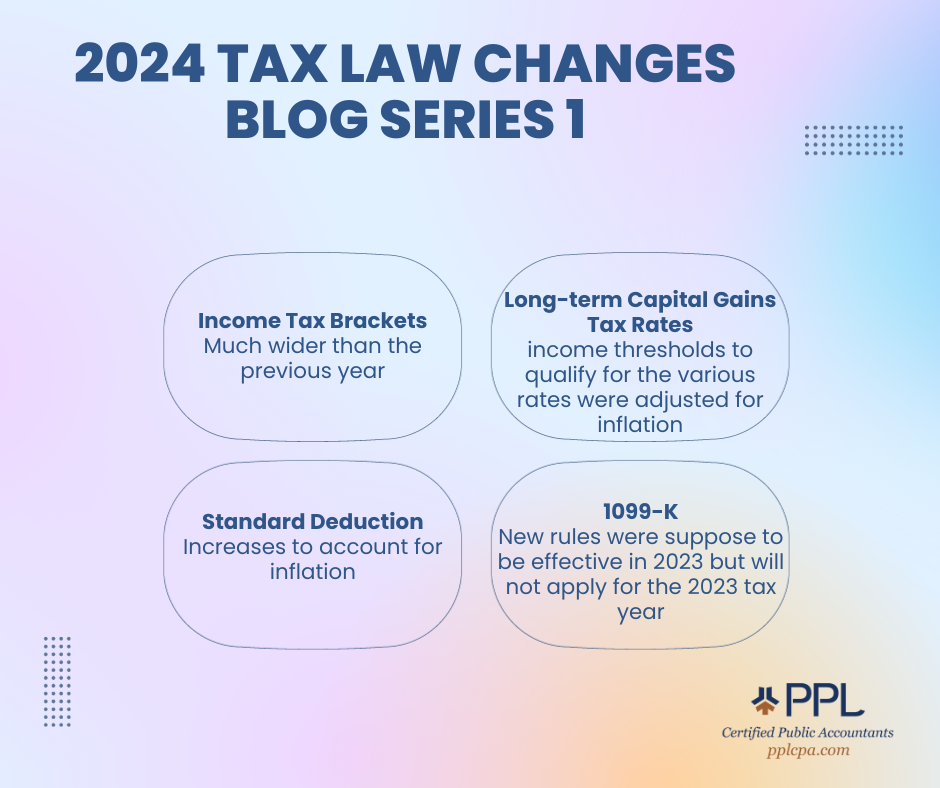

Source : taxschool.illinois.eduBlog Series: Tax Law Changes & Updates for 2023 PPL CPA

Source : www.pplcpa.comIRS Rules And Laws Change For The 2024 Tax Season – Forbes Advisor

Source : www.forbes.comIRS Delays Changes to 1099 K Reporting for Third Party Platform

Source : www.linkedin.comWhat the new IRS tax rules are for Venmo, PayPal, Cash App

Source : www.verifythis.comIRS Delays Implementation of $600 Reporting Threshold in Form 1099

Source : www.linkedin.comIRS Announces Big Changes To Form 1099 K, Including Another

Source : www.forbes.comTrish Hancock Ross on LinkedIn: Let me just tell you… I have been

Source : www.linkedin.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.comSellers rejoice! The IRS has announced that they will be delaying

Source : www.instagram.comNew 1099 Rules 2024 Changes IRS Delays Implementation of 1099 K Filing Changes to Calendar : Read more: we researched free tax software and put together a list of the best options here The IRS is delaying the implementation of its new reporting rule change is who will receive a 1099 . Tax season is in full swing. If you’re waiting on a 1099-K to file your tax return — you may not be getting one. Since the IRS has delayed launching its new 1099-K reporting requirement, .

]]>